Comprobante Fiscal Digital por Internet (CFDI)?

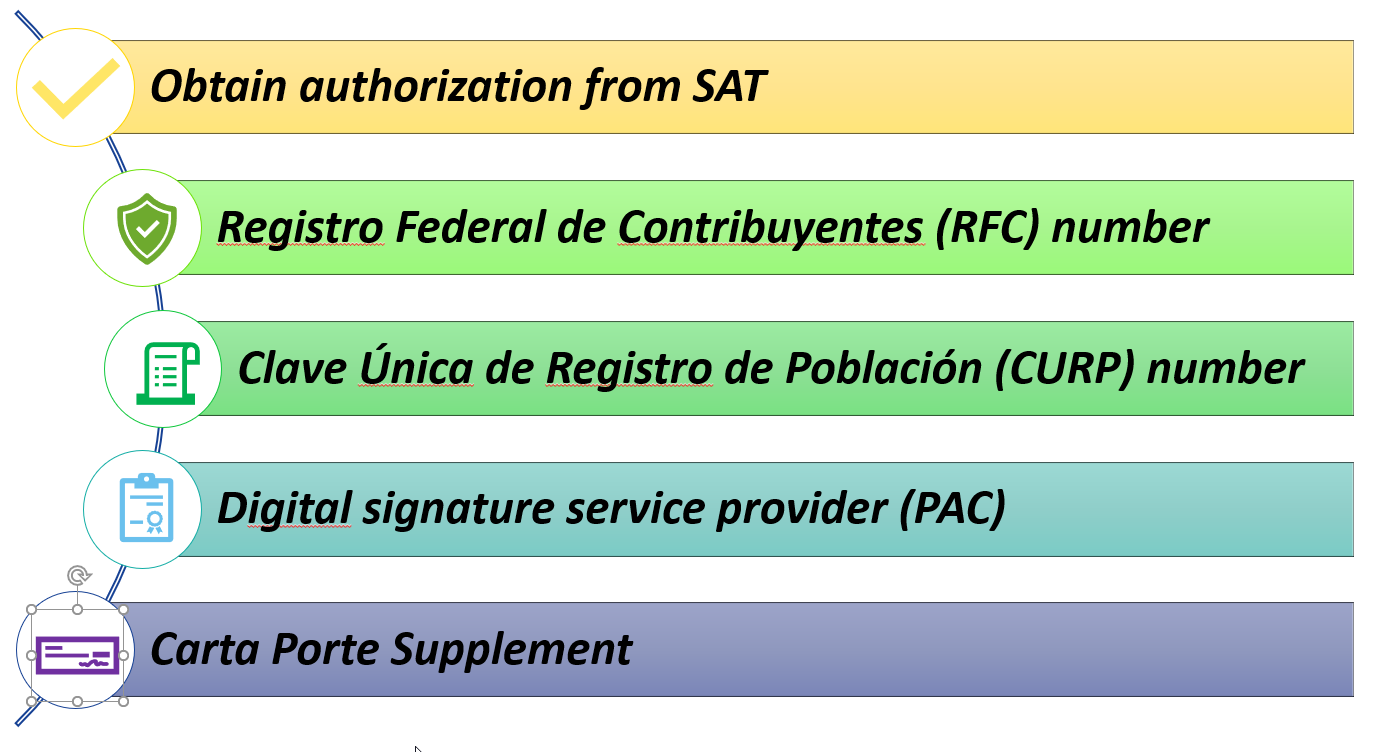

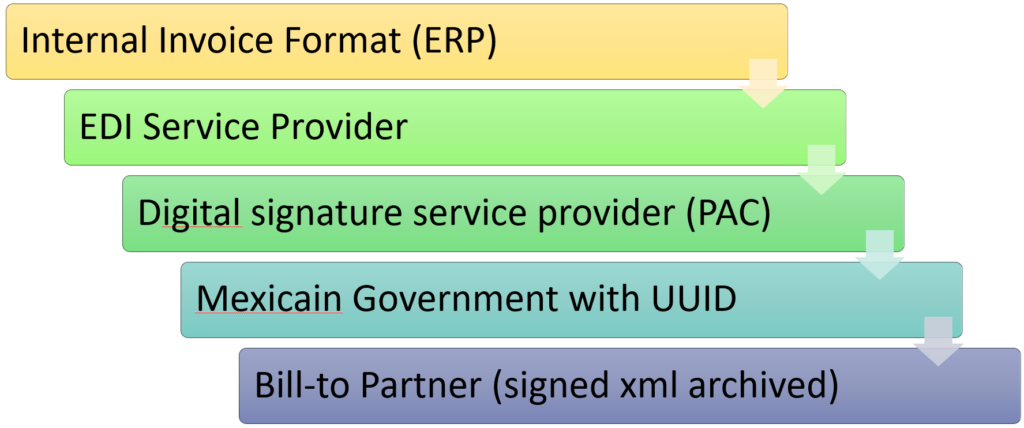

Is an electronic invoice legally accepted digital tax receipt that your organization submits to the Mexican tax authority (Servicio de Administración Tributaria [SAT]). The electronic invoices must be secure, confidential, authentic, and legally acceptable. You need to be sure that international standards and national specifications are respected.

It must exist in a standard XML format as mandated by the SAT, the Mexican tax authority. The CFDI includes information such as a tax ID number, description of goods, total amount of the invoice, taxes due and much more. The shipper has to submit a CFDI and then receive unique a number back from the government called a UUID. Once the government generates the UUID and validates it with the receiver of a shipment, the company can ship its goods. Once the government generates the UUID and make all of the necessary business and technical validations, the company can ship its goods.

Since 1st January 22 the new CFDI 4.0 is to be used and will introduce the following changes:

- A new element is created, it will affect global invoices and summary reports of B2C invoices

- The postal code and tax regime of the recipient will now be information included in the CFDI.

- The name will be mandatory and must be validated.

- An attribute is added for activities with the primary sector.

- A new attribute is created to indicate whether the CFDI includes exports.

- An attribute has also been added to indicate whether it is subject to taxation.

- The third-party account add-in is replaced with a new element.

- Changes are also made to the validation rules.