Electronic Invoicing

Accounting departments spend 30% of their time manually entering supplier invoices.

EDI invoicing (consisting of electronic invoicing and e-Reporting) is one of the two most frequent uses of EDI, together with EDI purchasing. Many trading partners only require EDI electronic invoicing as mandatory transactions, especially when dealing with small suppliers.

Contact IwayServices Experts

IwayServices, an EDI and SAP EDI consulting firm, can assist you in all stages of invoice dematerialization, regardless of the format. Our experts will provide you with the right answers and solutions to meet your needs.

First of all, it is a saving of 50 to 75% compared to paper processing (source).

The process cost of an invoice depends on several criteria. It is accepted that for an incoming invoice (on customer side), cost fluctuates between 14€ and 20€, and that for an outbound invoice (on supplier side), cost fluctuates between 5€ and 10€. Costs may be up than 100€ for invoices requiring a very precised control.

For electronic invoicing, the cost is 40-45 euro cents. Consumption-based or unit pricing can be advantageous for SMEs and allows costs to be adjusted in relation to turnover.

Regarding the electronic invoice, the cost is 0,4€ to 0,45€ by saving up to 30% of manual treatments.

e-Invoicing makes it possible to comply with regulations, and in particular to meet the requirements of the “electronic invoice” governed by Article 289 VI of the General Tax Code, as well as the development of the reliable audit trail, which will become mandatory in 2020.

E-invoicing also makes it possible to eliminate paper invoices in trade and as tax proof.

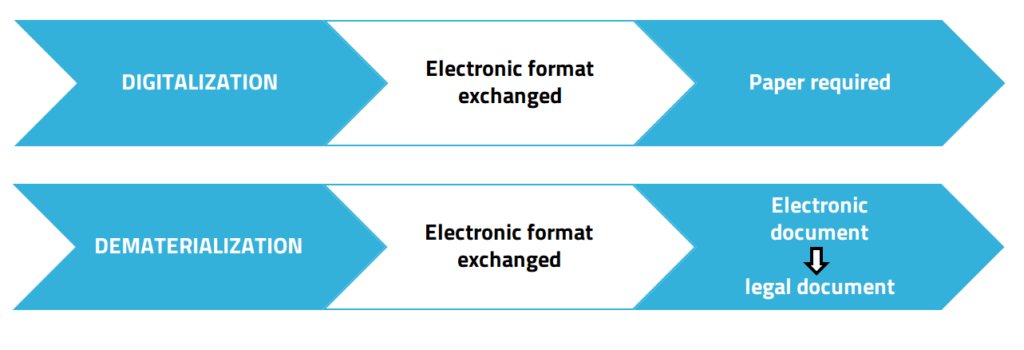

Nevertheless, it is important not to confuse digitisation with fiscal dematerialisation of invoices.

Contact IwayServices Experts

IwayServices, an EDI and SAP EDI consulting firm, can assist you in all stages of invoice dematerialization, regardless of the format. Our experts will provide you with the right answers and solutions to meet your needs.