Reliable audit trail

The Reliable Audit Trail (RAT) is one of the three dematerialisation processes admitted by the legislator and which is specific to France. The reliable audit trail is an internal documentation that explains and proves the invoicing process.

In all cases, the starting point of the reliable audit trail should be the starting point of the billing process.

Contact IwayServices Experts

IwayServices, an EDI and SAP EDI consulting firm, can assist you in all stages of invoice dematerialization, regardless of the format. Our experts will provide you with the right answers and solutions to meet your needs.

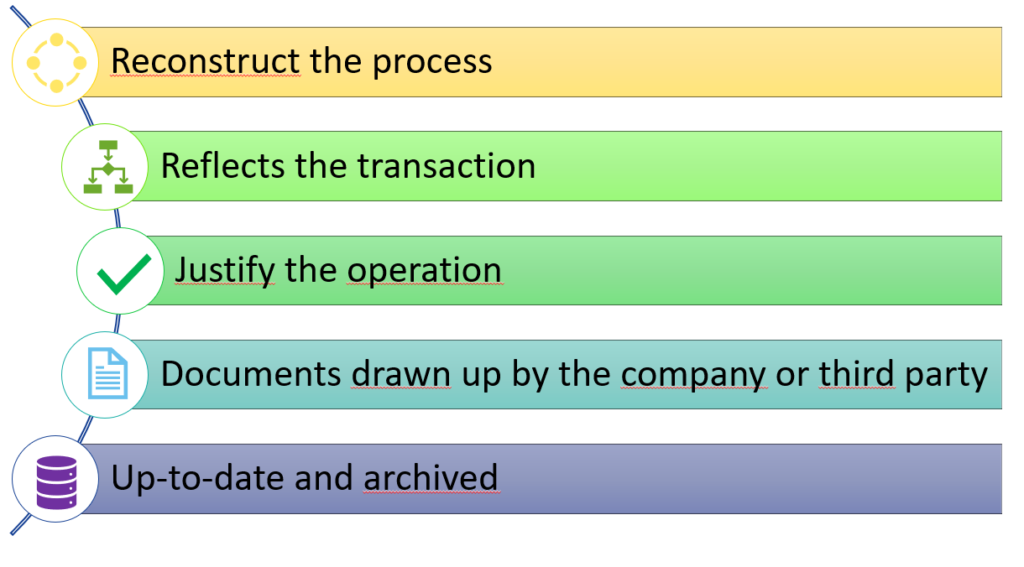

The audit trail should allow :

The audit trail can be made up of documents drawn up by the company itself (quotation, order form) or by third parties (account statements).

The audit trail must correspond to the processes that actually took place. For example, the purchase order must correspond to an order that was actually placed.

It is considered reliable when the administration can establish the link between the supporting documents, and between these and the transactions carried out.

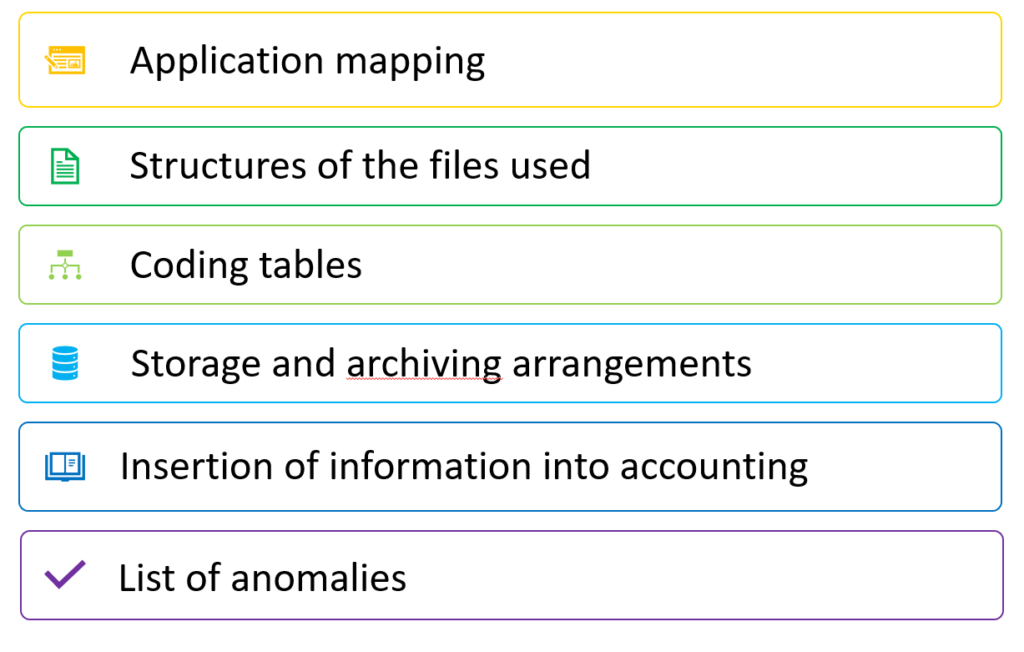

The controls must be documented, i.e. described, presented and explained by the company. The purpose of the documentation is to show that the controls implemented by the company are effective and real, and to enable the administration to easily understand them during an audit.

The document(s) should specify the actors involved in the checks and their respective tasks (who checks the documents and data, when and how).

These control documents should be developed at the time the audit trail is established and should trace all stages of the billing process.

The following documents must be presented to the administration:

If the PAF is incorrect, not up to date or does not exist, which is the case in many companies, the invoices are no longer considered as supporting documents for the transactions carried out. This means that :

(NB: The absence or inadequacy of controls put in place by the sender does not necessarily lead to the validity of invoices being called into question by the receiver).

In theory and in the short term, this solution seems simpler than EDI or electronic signature, but it is tedious in the long term because it must be continually updated. (Software evolution, change of personnel, change of accountant and the manual actions that follow).

Contact IwayServices Experts

IwayServices, an EDI and SAP EDI consulting firm, can assist you in all stages of invoice dematerialization, regardless of the format. Our experts will provide you with the right answers and solutions to meet your needs.