- 25 February 2022

- By: IwayServices

- Blog

What information must be declared via the e-reporting system?

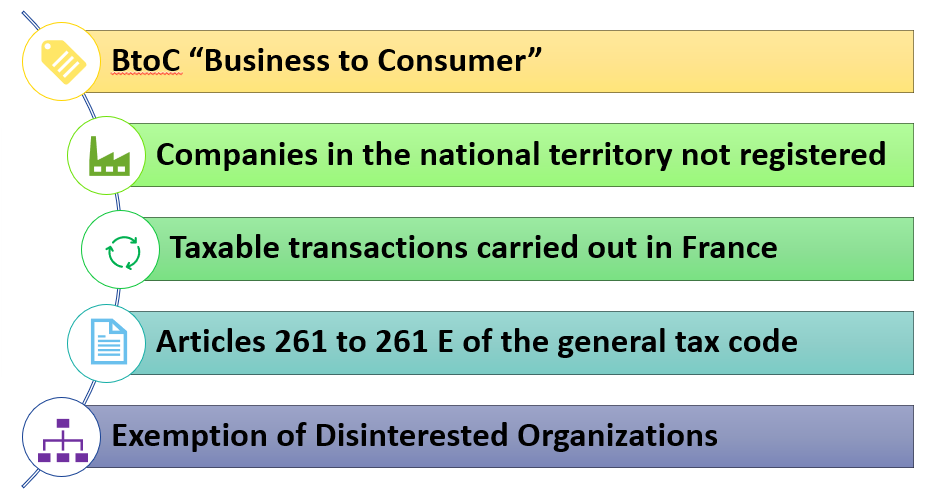

The companies that will have to send the e-reporting are:

- Subject to VAT in France and who trade with individuals and non-taxable institutes (BtoC known as “business to consumer”),

- With companies not established on the national territory (i.e. taxable persons who have no establishment, domicile or residence in France)

- Taxable transactions carried out in France with non-taxable institutes (particularly individuals).

On the other hand, transactions benefiting from a VAT exemption based on Articles 261 to 261 E of the General Tax Code, exempt from invoicing, do not fall within the scope of e-reporting. This is particularly the case for certain banking and insurance operations, medical and health services, educational services, operations carried out by non-profit organizations whose management is disinterested.

How will I transmit the data of my transactions to the administration ?

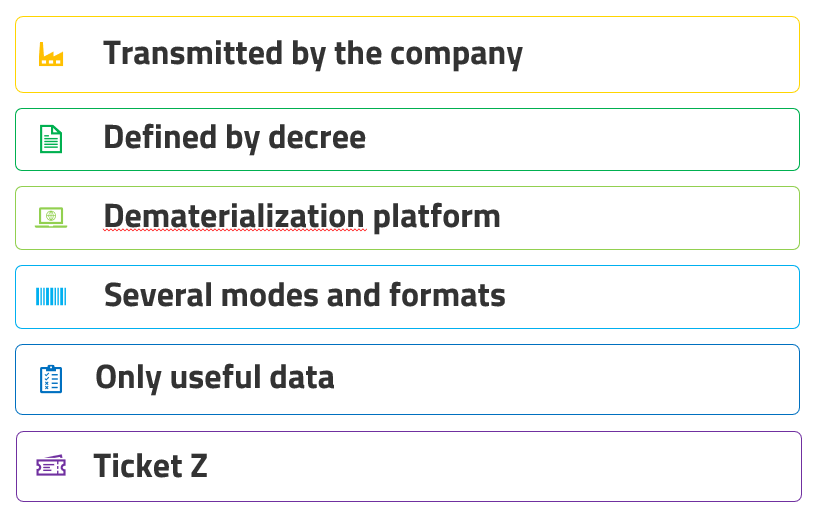

In general, the data of e-reporting transactions (the list of which will be defined by decree that has not yet been published) must be transmitted by the company carrying out the operation via a dematerialization platform partner of administration.

Several modes and formats of transmission will be possible. The Z ticket, in dematerialized and structured format, can be a deposit format if you have cash register software. If you issue invoices to your private customers, you can submit this invoice directly in dematerialized and structured format on the partner dematerialization platform you have chosen. It will be responsible for extracting the only data useful for e-reporting for the purposes of the tax administration.

In the absence of cash register software or system, or of deposit of invoice, the company will have the possibility of entering or transmitting a summary statement of the transactions carried out over the period. The data transmitted in e-reporting will be limited to the amount of the transactions and the related VAT.

What is the Z ticket ?

“Z” being the last letter of the alphabet, remember that the cash Z is the last report of the day and it closes the day from an accounting point of view.

Not only does the Cashier Z show the final summary of the day’s sales, refunds, and payment methods, it resets all counters to zero in preparation for the next day.

Iway Services supports you in all stages of Electronic Invoicing, whatever the format.

Sources :

Contact IwayServices Experts

IwayServices, an EDI and SAP EDI consulting firm, can assist you in all stages of invoice dematerialization, regardless of the format. Our experts will provide you with the right answers and solutions to meet your needs.