- 12 January 2022

- By: IwayServices

- Blog

Continuous Transactional Control, Clearance and e-reporting

Which models to adopt?

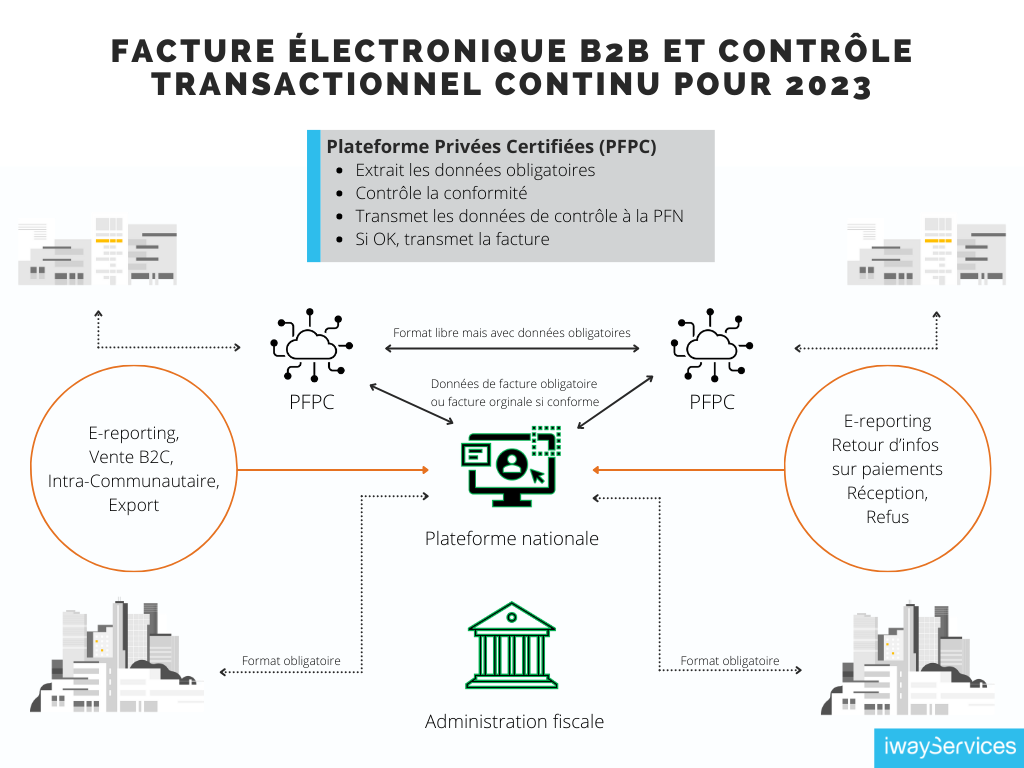

Continuous Transactional Control, Clearance and e-reporting are models that are rolling out around the world and come to us from Latin America. The Hexagon will adopt a French version which will use a national platform AND certified platforms for clearance and e-reporting.

Clearance is a “pre-validation” before transmission in order to have the invoices formally validated before transmission, the tax administration can then directly take care of the transmission to the recipient.

The CTC (Continuous Transactional Control) allows a VAT report to be transmitted in real time to the tax authorities, for control and for preparation of Clearance declarations.

In addition to electronic invoicing, which will make it possible to carry out part of the checks and pre-declarations of VAT, it will be necessary to send e-reporting on sales and payments. The scope of this electronic report (frequency, data, sender, etc.) has yet to be defined, but the DGFIP ensures that the mandatory data to be provided will be less than those required on the invoice.

Contact IwayServices Experts

IwayServices, an EDI and SAP EDI consulting firm, can assist you in all stages of invoice dematerialization, regardless of the format. Our experts will provide you with the right answers and solutions to meet your needs.

French-style e-Invoicing architecture

To concentrate the flows towards the Public Finances (DGFIP), a national platform (PFN) will be at the center of the implementation.

- Perform checks on the invoices sent and extract the information required by the DGFIP.

- Manage a national directory of companies (which will be identified by their SIREN / SIRET.

- Support companies by offering a direct exchange capacity through the platform

This will limit the number of formats to those required for reception by the PFN, online entry or creation of a hybrid PDF invoice (Invoice-X) and will allow an exchange of statuses and include archiving.

Certified private platforms (PFPC) can process invoices in various formats, even if they are not in the mandatory format cited by the DGFIP, but they are under the obligation to reliably extract the data expected by the Administration and to control the conformity of the data under the same conditions as the PFN.

Contact IwayServices Experts

IwayServices, an EDI and SAP EDI consulting firm, can assist you in all stages of invoice dematerialization, regardless of the format. Our experts will provide you with the right answers and solutions to meet your needs.

Sources :