IwayServices supports you in achieving your reliable audit trail and to propose an action plan for all the processes related to EDI / PDF invoices.

RELIABLE AUDIT TRAIL and ACTION PLAN

IwayServices supports you in achieving your reliable audit trail and to propose an action plan for all the processes related to EDI / PDF invoices.

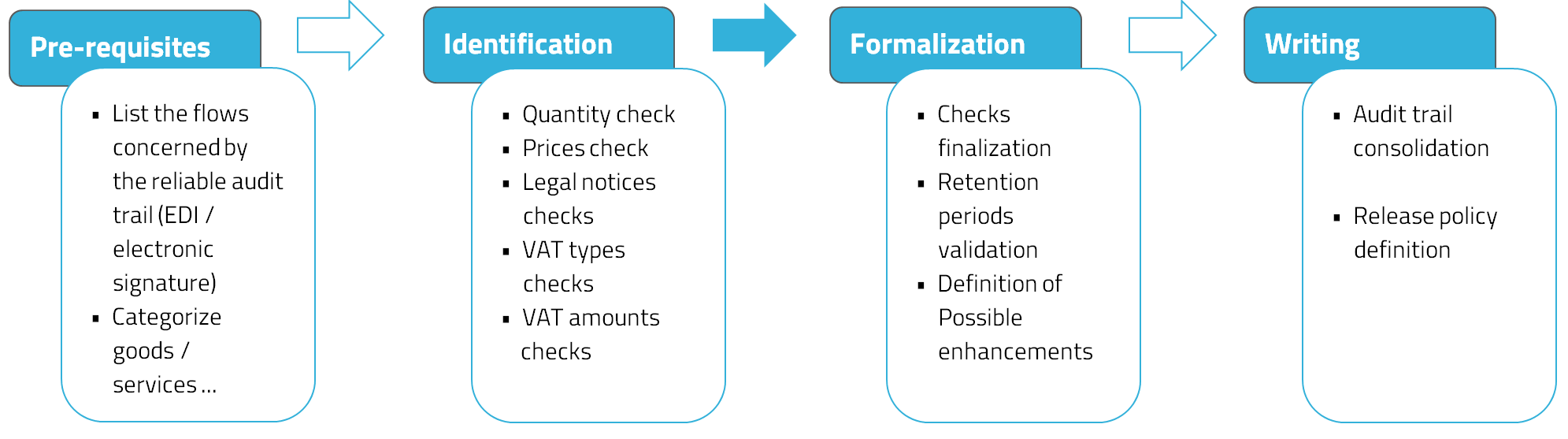

Our functional experts will assist you in:

The European and French authorities invite companies to use electronic invoicing.

Since January 1st, 2020, the reliable audit trail is mandatory in any electronic invoicing process. In addition to the legal guarantee, it improves the visibility, reliability and productivity of your accounting processes.

Without a reliable Audit Trail, your business is exposed to legal penalties, repayment of deductible VAT and fines for late supplier payments.

Since January 1st, 2013, following the transposition of a European directive number 2010/45/CE, three billing methods coexist:

| EDI EXCHANGE |

| SECURE INVOICE “GENERAL SAFETY REFERENCES (RGS **)” |

| OTHER INVOICE FORMATS (PAPER, UNSIGNED PDF, PDF RGS *) |

The two first modes guarantee the legal character of the invoice (authenticity, integrity and readability), but regarding PDF invoices and paper invoices, tax administration now requires a reliable audit trail to guarantee the origin of the bill.

Since 2013, a reliable audit trail documentation is mandatory and has to describe the flow between invoices issued / received and deliveries of goods / services performed. Companies must describe the invoicing processes (purchase / sale) and the controls setup in order to prove the invoice origin and the compliancy between deliveries of goods / services and the invoice.

It concerns all companies, but type of documentation depends on the size of the company belong to tax administration:

|

VERY SMALL COMPANIES |

Oral Specification | iwayServices defines a document describing the main stages of the reliable audit trail process, and a diagnosis to identify the strengths and weaknesses of your organization, and suggests improvement thanks to its functional experts. |

| SME | Synthetic Written Specification | iwayServices prepares documentation describing the main stages of invoicing and the control points established to validate the matching of the invoicing and the deliveries of goods / services. The strengths and weaknesses identification of your organization will allow improvement proposition thanks to our functional experts. |

| BIG COMPANIES | Detailed Written Specification | iwayServices is involved in all or part of the reliable audit trail and involves its functional experts for improvement proposals. |

*Reliable Audit Trail

Lack of reliable audit trail during a tax audit can lead to:

Since the invoices concerned are not anymore considered as reliable, they are not anymore tax compliant. No dispute is then possible, and sanctions are automatic. The European authority estimates the loss resulting from VAT fraud at 20 billion euros.