- 28 March 2022

- By: IwayServices

- Blog

Comprobante Fiscal Digital por Internet (CFDI) « Online digital tax receipt »

The Online Digital Tax Receipt (or Comprobante Fiscal Digital por Internet) of the Mexican electronic invoicing system is a legally accepted digital tax invoice that your organisation submits to the Mexican tax authority (Servicio de Administración Tributaria [SAT]). Electronic invoices must be secure, confidential, authentic and legally compliant. You must ensure that international standards and national specifications are met.

The document must exist in an XML format as mandated by SAT, the Mexican tax authority. The CFDI includes information such as a tax identification number, description of goods, total invoice amount, taxes due and much more. The shipper must submit a CFDI and then receive a unique number from the government called a UUID. Once the government generates the UUID and validates it with the shipper, the company can ship its goods.

As of 1 January 22, the new CFDI 4.0 is will be used and will introduce the following changes ( * element and attribute are xml format terms):

- A new element* is created which will affect global invoices and B2C invoice summary reports

- The postcode and tax status of the recipient will now be information included in the ICRFC.

- The name will be mandatory and must be validated.

- An attribute* is added for primary sector activities.

- A new attribute* is created to indicate whether the CFDI includes exports.

- An attribute* has also been added to indicate whether it is subject to tax.

- The third party account complement is replaced by a new element.

- Changes are also made to the validation rules.

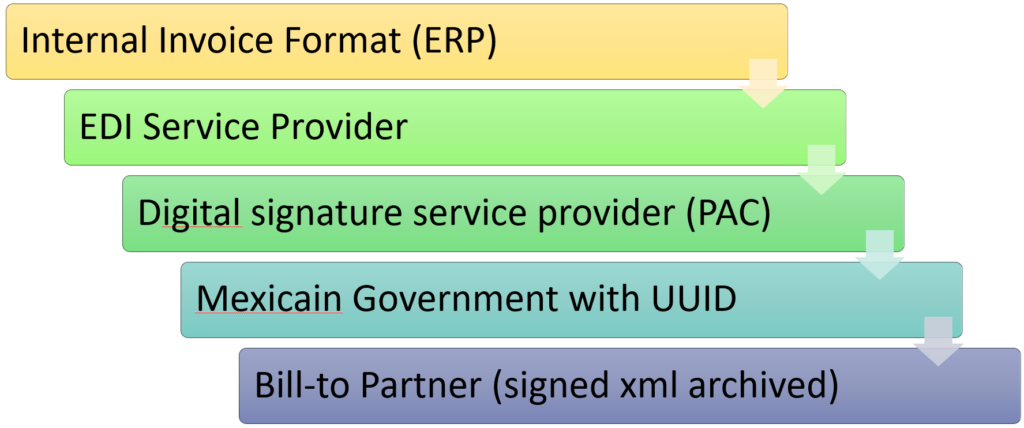

Method for generating electronic invoices

Invoices are verified and certified by a digital signature service provider (DSP). Before you can use the CFDI method to generate electronic invoices, your organisation must establish a web service connection with an approved PAC. From your ERP, you send an invoice to your EDI provider who maps it to the PAC format. The PAC validates each invoice, assigns a folio number, and incorporates the digital stamp (UUID) provided by the Mexican tax authorities. Once the approval process is complete, your organisation receives the approved XML message and can then submit the invoice in XML or PDF format.

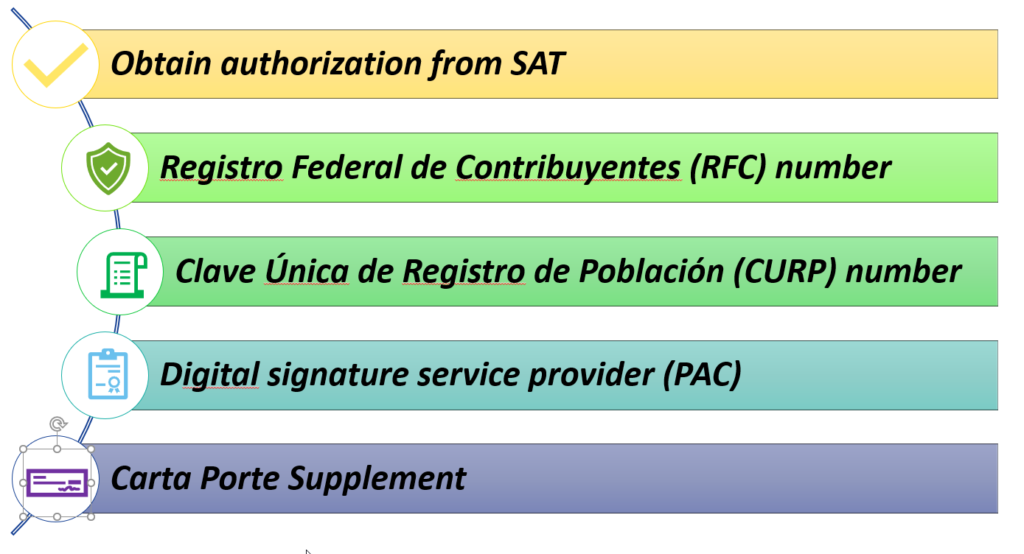

Requirements for the use of electronic invoices

- Obtain a Federal Taxpayer Registration Number (RFC), Unique Population Registry Key (curp) and State Registration Number from SAT.

- Ensure that the PDF and XML files meet SAT requirements. These files are sent to clients as attachments. The generated XML file must be based on the XML Schema Definition (XSD) provided by SAT. You must archive the XML file for each electronic invoice.

Carta Porte ?

The new supplement known locally as Suplemento de Carta Porte must be added as an annex to the electronic transfer invoice (CFDI de Traslado) or the revenue CFDI (CFDI de Ingresos) issued for transport services.

The Carta Porte aims to ensure the traceability of products moving within Mexican territory by requiring additional information on the origin, location, precise destination and transport routes of products transferred by road, rail, sea or air to Mexico.

This change comes into effect on 1 October 2021, freight carriers must have a copy of the Carta Porte Supplement in the vehicle that proves legal compliance with this mandate.

Contact IwayServices Experts

IwayServices, an EDI and SAP EDI consulting firm, can assist you in all stages of invoice dematerialization, regardless of the format. Our experts will provide you with the right answers and solutions to meet your needs.