What is an invoice ?

The invoice is an official document that is at the crossroads of several regulations, which sometimes leaves room for several interpretations that can contradict each other.

In this article, we will focus on the generalities that govern electronic invoicing.

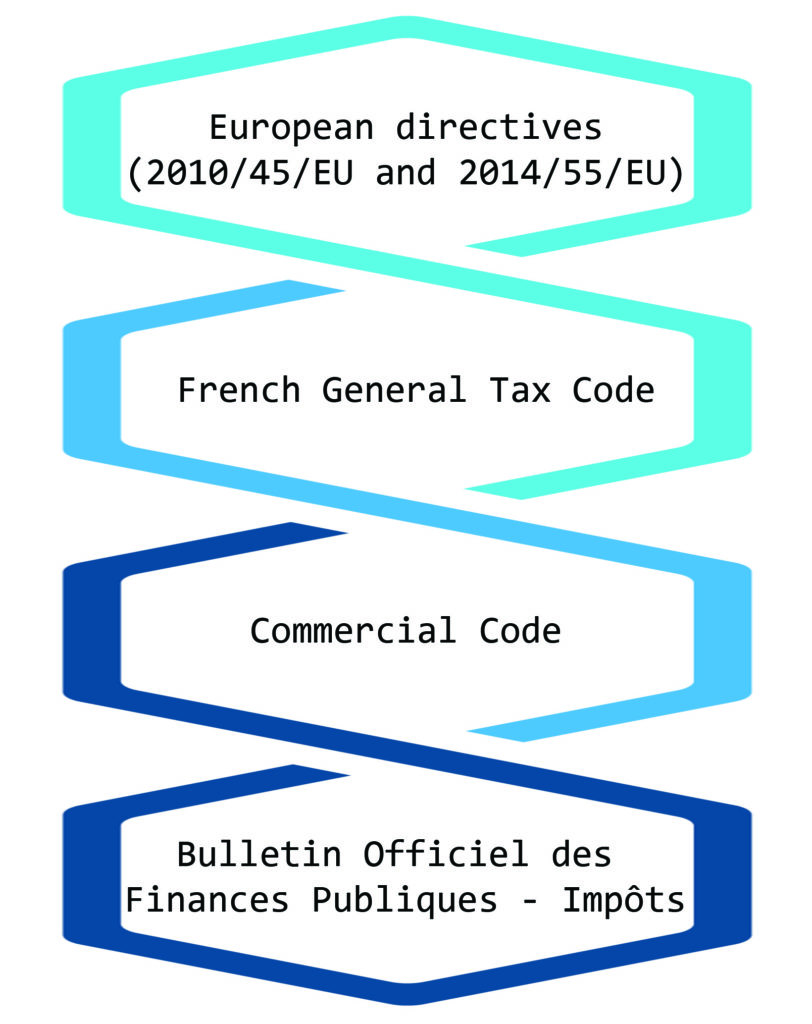

Although each country remains sovereign in the writing of tax regulations, it is the European directives (2010/45/EU and 2014/55/EU) that inspire the French General Tax Code and the Commercial Code , especially at the level of electronic invoicing.

Invoices serve several purposes. It is a legal proof of the service rendered, or of the goods sold, and establishes the seller’s right to claim payment. It is an obligation to invoice any professional activity.

It also holds the details of the sale and serves as accounting evidence for the preparation of the annual accounts.

Contains information on the VAT applicable and of any deductions made.

And of course, it allows the tax administration to exercise its right of verification.

Et évidemment, elle permet à l’administration fiscale d’exercer son droit de vérification.