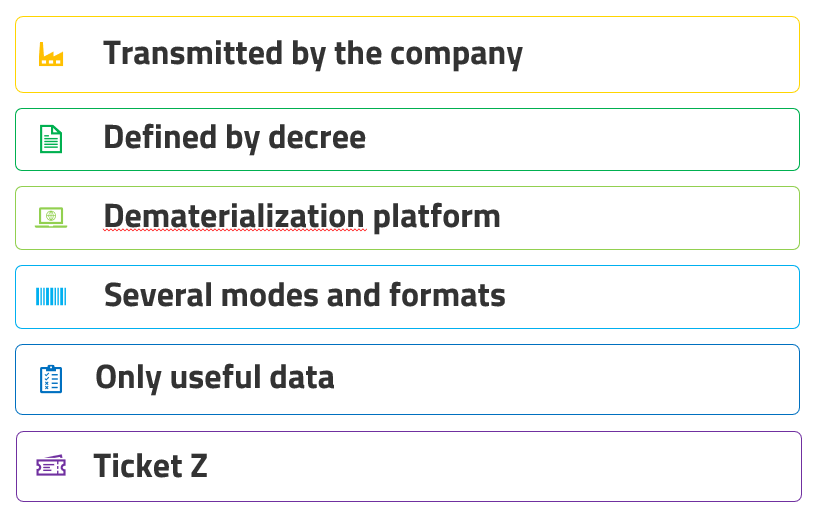

What information must be declared via the e-reporting system?

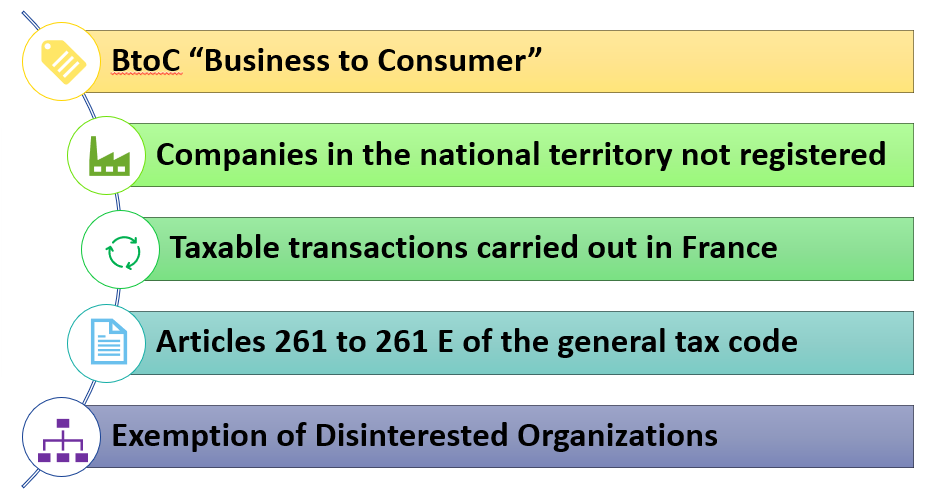

The companies that will have to send the e-reporting are:

- Subject to VAT in France and who trade with individuals and non-taxable institutes (BtoC known as “business to consumer”),

- With companies not established on the national territory (i.e. taxable persons who have no establishment, domicile or residence in France)

- Taxable transactions carried out in France with non-taxable institutes (particularly individuals).

On the other hand, transactions benefiting from a VAT exemption based on Articles 261 to 261 E of the General Tax Code, exempt from invoicing, do not fall within the scope of e-reporting. This is particularly the case for certain banking and insurance operations, medical and health services, educational services, operations carried out by non-profit organizations whose management is disinterested.